When you apply for a visa—whether for work, study, or business—a lot of attention goes into your financial documents. But does your credit score actually affect your visa approval? Although there’s no direct link between a credit score and visa decisions, having a strong credit profile can help reinforce your credibility and bolster your application.

A credit score is a three-digit number that represents your creditworthiness. It’s determined by several financial factors: outstanding debts, payment history, credit utilization, late payments, and more. In India, credit bureaus like CIBIL, Experian, CRIF High Mark, and Equifax calculate and report these scores — typically ranged between 300 and 900. The higher the score, the better your perceived financial health. mint

Lenders use this score to decide whether to approve loans or credit cards. But embassies and immigration authorities may also look at your financial stability when evaluating visa applications. mint

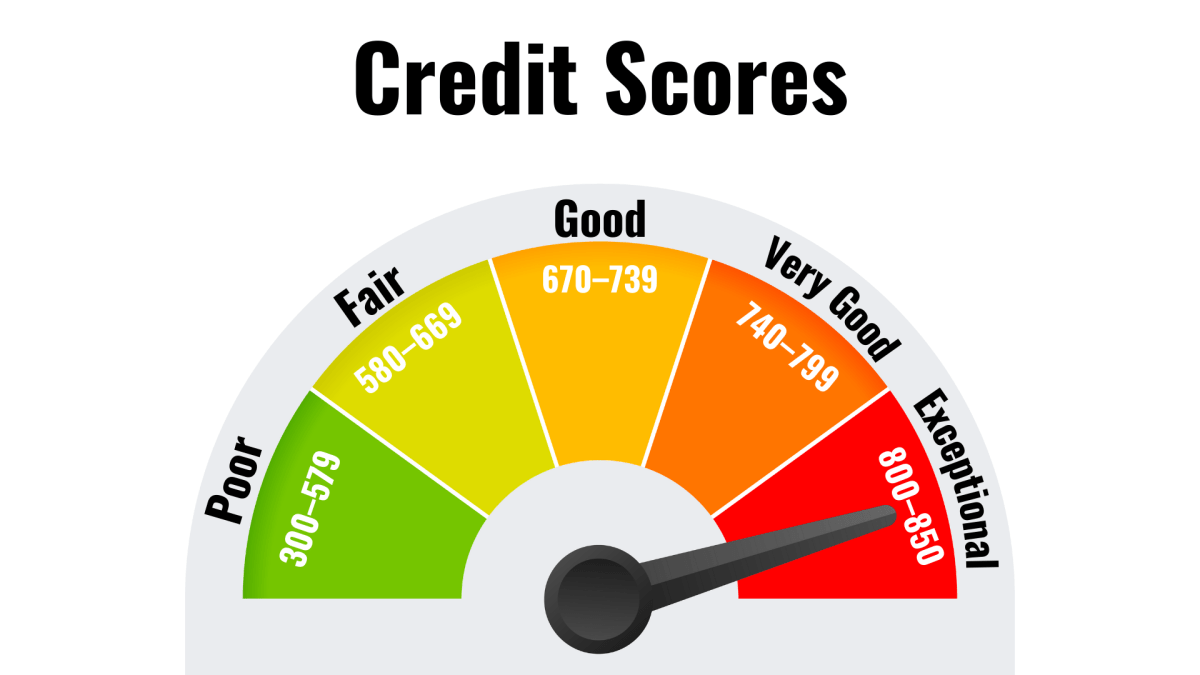

Here’s a general guide to how score ranges are interpreted:

| Score Range | Perception of Creditworthiness | Implications |

|---|---|---|

| 300–549 | Poor | Loan rejections likely; only with strong security or income |

| 550–699 | Fair | May get loans, but with tighter conditions and higher interest |

| 700–749 | Good | Decent chance for approval at better rates |

| 750–900 | Excellent | High approval chances, favorable terms |

(These are illustrative ranges — actual thresholds may differ across bureaus.) mint

Here are some ways your credit profile might indirectly play a role in your visa journey:

No direct rule, but financial scrutiny matters

Visa authorities usually don’t ask specifically for a credit score. But they do assess your overall financial stability. A high score strengthens the perception of responsible financial behavior, while a weak score may raise doubts. mint

Signals of financial responsibility

A good score suggests disciplined repayment behavior and better fiscal management, which can reduce perceived risk for immigration authorities. mint

Helping secure travel loans

If you need to take a loan to fund your travel, education, or business overseas, a better credit score could make obtaining that support easier. mint

Strengthening related documents

A solid credit history complements other financial proofs (bank statements, property documents, salary slips), making your application more convincing. mint

In jurisdictions with stricter financial criteria

Some countries (e.g. UK, US, Canada) place heavier emphasis on showing stable finances depending on visa categories. In those cases, a strong credit record can tip the scales in your favor. mint

A credit score doesn’t decide your visa’s fate, but it can enhance your financial profile and bolster your credibility. For Indian applicants, maintaining a clean and healthy credit history positions you better—not just for domestic loans, but also for international visa requirements and travel arrangements.